Bitcoin could reach $150,000 by the end of 2025 on the back of increased adoption by institutions and the support of the US president-elect Donald Trump for cryptocurrencies, say forex industry executives.

However, some analysts suggest that it is important for Bitcoin to close above $100,000 for a few months before this becomes support level for the cryptocurrency.

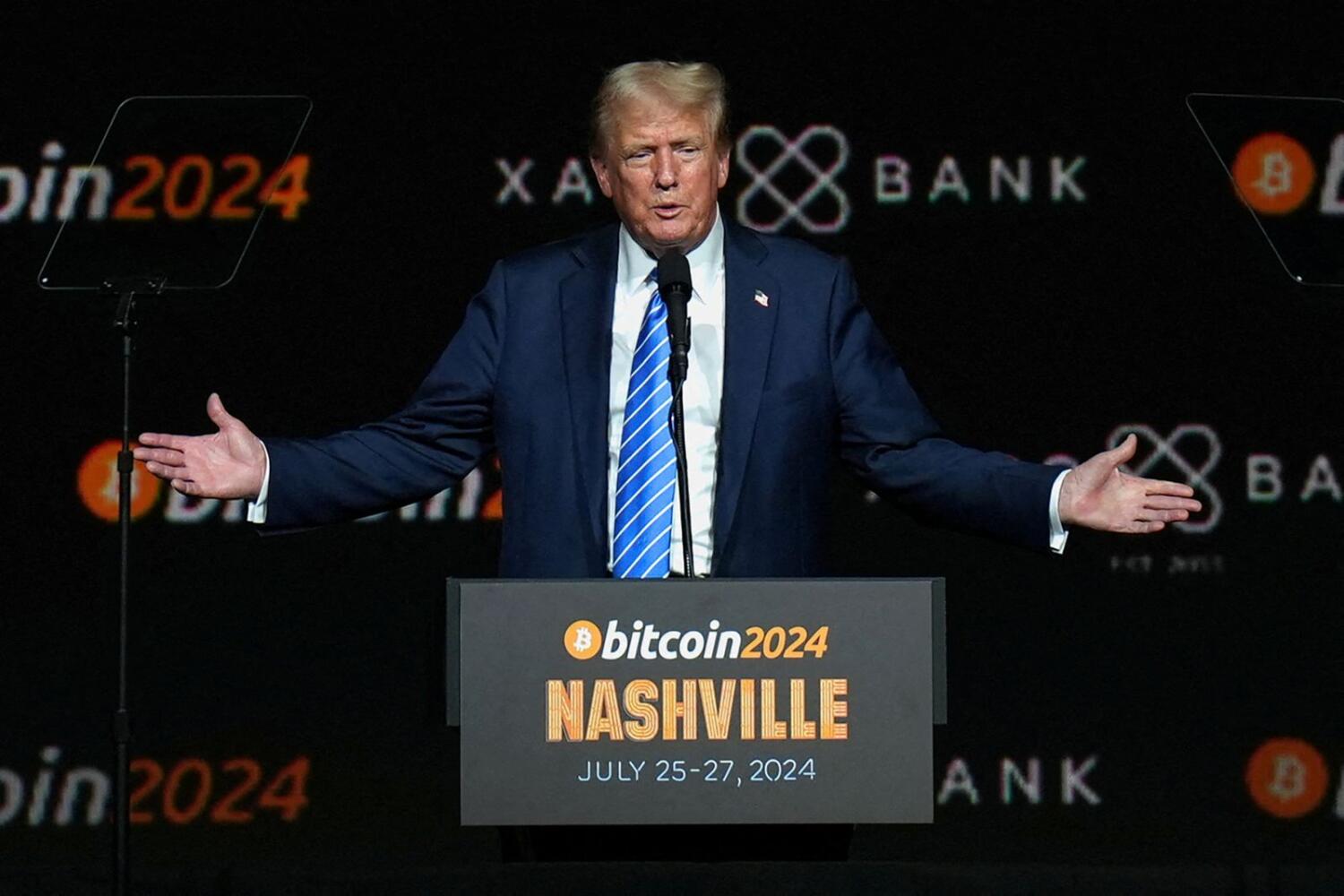

Bitcoin recently crossed $100,000, but slipped again below this key psychological level. It rose again after Trump launched his own cryptocurrency and reports of him planning to release an executive order to make crypto a national priority.

“Cryptocurrency is seeing massive adoption from institutions and retail clients to hedge against inflation and other risks like they used to do with the gold. The coming of Donald Trump into power is positive. We have cycles in cryptocurrency market and people are moving from Bitcoin to Ethereum and others,” said Konstantinos Chrysikos, director of customer relations at Kudo Trade.

“I think Bitcoin will consolidate around $110,000 and $120,000 before eventually touching $150,000 by the end of 2025. This is a very conservative scenario,” he said, adding: “It sounds crazy but we have seen crazy things happening in Bitcoin and cryptocurrency that nobody could believe.”

Farah Mourad, senior market analyst at Equiti Group, said cryptos have benefitted from Trump’s support as well some international transactions between China and other countries in cryptos.

“Though a correction in Bitcoin is not expected, but if a correction happens, I believe that old highs around $72,000-$75,000 might be the support level. But if this momentum continues, cryptocurrency can benefit from weaker dollar or gold and other aspects. I need to see Bitcoin closing months above $100,000 to decide that momentum is still there. As long as $100,000 is being tested and broken time and again, I would not comment. It is always good to diversify to Ethereum and Ripple,” she said.

Wael Makarem, senior market strategist at Exness, attributed the rise in cryptos to a drop in active supply.

“We need to keep an eye on active supply. I don’t think everyone should be so optimistic about the market when Trump joins office as we have some harsh ways of dealing with other counterparts like EU and China because this will create chaos in the market and be risk-averse,” he said.

Makarem sees $120,000 as a close target because when active supply drops fast, the movement becomes exponential so it will be hit easily. “We recently saw Bitcoin rising from $88,000 to $97,000 in a very short span of time,” he added.

Will the dollar weaken or strengthen?

In addition, the US dollar is also expected to become stronger with Trump coming back to power on January 20, 2025.

Wael Makarem added that Trump brings volatility to the market and the market simply tasted over the past two weeks when there were headlines around tariffs.

“The market is betting on tariffs that could support the dollar. If there are no tariffs and tense behaviour, there is no need for a safe haven dollar and rather people will sell the dollar and go for other currencies as we recently saw the euro and other currencies rebounding against the greenback. The market could also be impacted by the Federal Reserve’s decision to cut rates.”

Importantly, he said the dollar is strengthening because its counterparts are getting weaker. “For example, the situation in Europe and the UK are not helping the euro and pound while the US economy is still sold at the same time,” added Makarem.

Farah Mourad also said the greenback gained because of Trump coming into power and the weakening of other currencies because growth is dropping in the eurozone and challenges in the UK economy.

Konstantinos Chrysikos of Kudo Trade sees the greenback gaining around 5 to 10 per cent this year, depending on the US president’s policy and tariff war.

YAllA TV – www.yallatv.ae